The 2021 Corporate Transparency Act has instituted new reporting requirements that affect companies with owners in foreign countries, in an attempt to prevent money laundering, tax fraud, and other illicit activities. The Beneficial Ownership Information (BOI) report requires companies to disclose owners benefitting from their business activities to the U.S. government, specifically to the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN). “Owners” include any individual or group of individuals who have direct or indirect ownership or control of an entity. This reporting requirement went into place in January 2024 and companies are confused about whether they qualify for exemption and how to complete the report. Companies have always been required to report foreign ownership, but this new reporting requirement applies for all owners of the entity, not just the foreign owners.

Who has to file a BOI report?

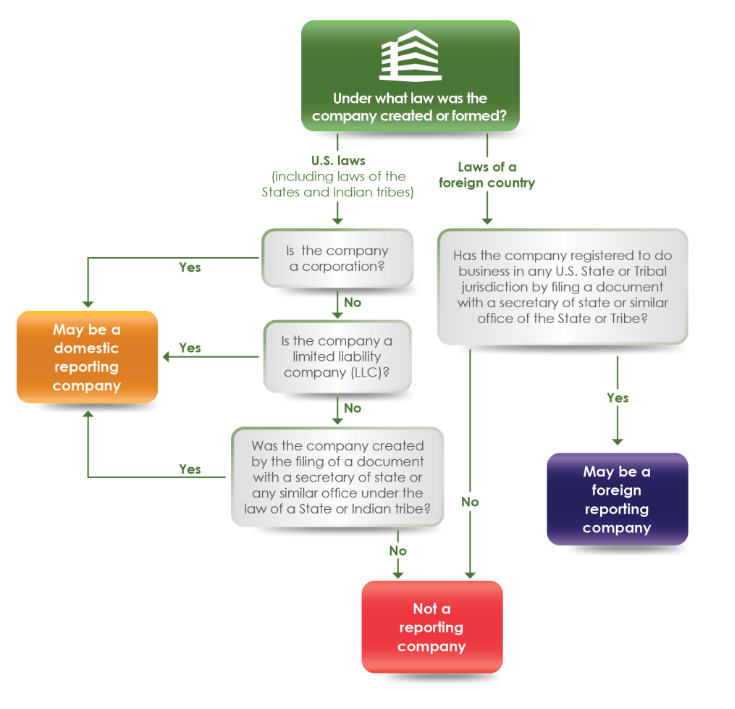

A reporting company is a corporation, LLC or any other entity that’s registered to do business in the US. Below is a succinct infographic from fincen.gov:

Who is exempt from filing the BOI Report?

The most common exemptions are inactive entities, publicly traded companies that meet certain requirements, many nonprofits, and some large operating companies. Here’s a full list from FinCEN. If your company has always been exempt, there is no reporting required to indicate that you’re exempt each year. If your company becomes exempt after filing BOI reports in previous years, then it will need to file a BOI for the year it’s now exempt and indicate the changing exemption status.

What are the BOI report filing deadlines and consequences?

Since this is a new filing obligation in 2024, filers have not faced consequences yet but civil penalties of up to $500 for each day that the violation continues will be applied, and a criminal penalty of up to two years imprisonment and a fine of up to $10k are possible. Reporting companies that were registered to do business before January 1, 2024 will be required to file by January 1, 2025. Reporting companies that were registered in 2024 will have 90 calendar days to file, while reporting companies registered on or after January 1, 2025 will have 30 calendar days to file.

How do companies complete the BOI Report?

Companies can easily complete the reporting on their own by visiting FinCEN’s E-filing website. If questions arise, companies should talk with their attorney, rather than their CPA, for guidance. FinCEN has designed the process so that companies don’t need excessive third-party help to complete the reports. The report does not need to be filed annually. After the initial filing, it should be re-filed as any ownership updates occur or corrections are necessary.

Has your company submitted the new BOI report? Still confused about your obligations? Schedule a meeting with us to talk through your reporting requirements for 2024.